Spread Your Wings: Broaden Your Investment Horizons Offshore

Spread Your Wings: Broaden Your Investment Horizons Offshore

3 November 2021

Expressed simply, diversifying is about ‘not putting all your eggs in one basket’. Diversification may not prevent all losses, but it could reduce the impact of any single disaster.

If all your assets were concentrated into just one or two investments and those assets suffered a setback, then your entire portfolio would be hit hard. But one or two negative returns across a well-diversified portfolio will have much less impact.

That’s why you should look at offshore investing. It reduces the risk of larger losses if the New Zealand economy or share market slows down, or drops in value. However, as with all investments, there are some important factors to consider.

Small but performing well: the New Zealand share market

The New Zealand share market makes up only around 0.50 per cent of the value of the world’s share markets, making our market very small indeed.

If you think that extending your shareholding to Australia will help, then you may be surprised to know that Australia makes up only around 2.36 per cent of total global share markets. For that reason, the small size of the Australasian markets is a good reason to look elsewhere.

Interestingly, when considering performance alone, New Zealand seems to be a better place to invest, according to data supplied by Craigs Investment Partners. For the six months ending 31 March 2016, the NZX50 (the top 50 stocks on the New Zealand stock exchange) did a lot better than many markets. The NZX50 rose a staggering 20.7 per cent, while over the same period, the MSCI All Country Index fell 2.2 per cent, in New Zealand dollar terms.

Looking back over the past 10 years, the NZX50 index has returned 6.2 per cent, compared to the MCSI world index, which was up only 3.4 per cent a year over the same period.

Profound effects of foreign investment into New Zealand share market

Money flowing in and out of share markets can affect them differently. In smaller markets, such as New Zealand, foreign money has a much bigger impact on performance than it would on the US markets. So, we should expect more short-term movement in share values in the New Zealand share market.

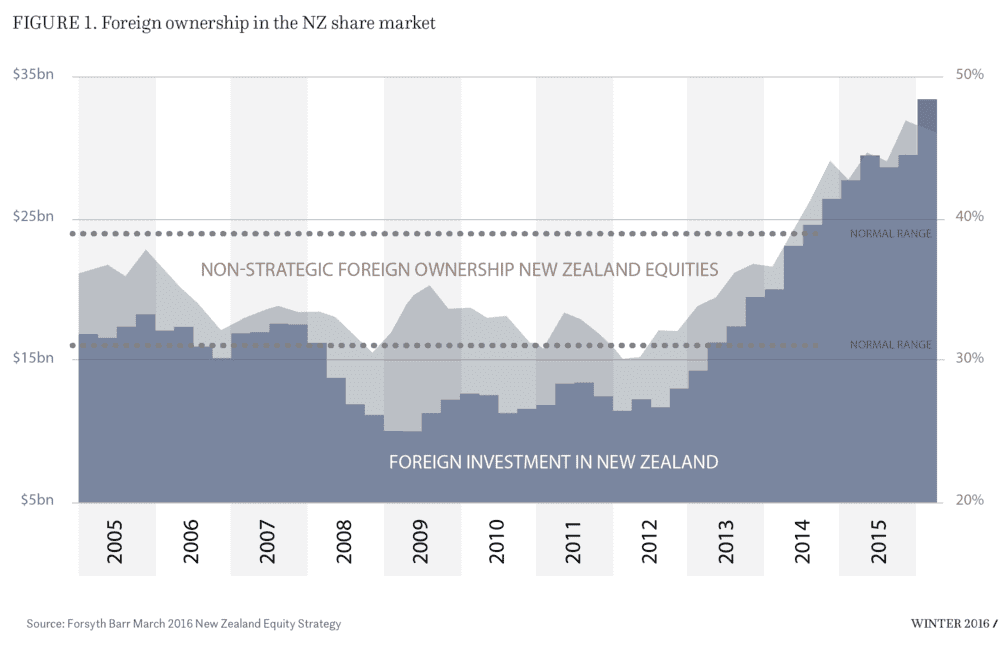

Foreign investors now own almost half of all stocks listed on the NZX. According to a recent report by Forsyth Barr, this level of ownership is 11.3 per cent higher than New Zealand’s average over the past 10 years. (See Figure 1, which is a graph showing how foreign investment in New Zealand has increased dramatically).

The more than NZ$30 billion of foreign investment is an extraordinary level of cash flow into such a small market. So it’s not surprising that we now find the New Zealand share market trading at historically expensive levels. The risk of loss in the local market has increased, with the fear that foreign investors could withdraw.

Expand your opportunities

When designing a portfolio, it’s important to make sure that you understand the strategy you’re trying to put in place, and to consider your underlying investments. Let’s look at the companies within the NZX50.

If you invested solely into the New Zealand market, you would have a large ‘overweight holding’– an excess amount of one type of investment. In this case, you would have excess investment into energy stocks, such as Genesis, Contact, or Meridian Energy, local listed property trusts, and the finance sector.

And if you expanded your investments into Australia, through the ASX200, that would not add much in the way of diversification. There, you would have a heavy weighting to Australia’s dominant sectors – finance and the very volatile commodity industry.

By venturing further afield than home or our closest neighbour, you are open to a world of opportunities outside New Zealand, which you would miss if you did not invest offshore.

You would be able to make investments in fields such as biotech, water, emerging markets, or the ‘internet of things’ – the rapidly growing market for smart appliances that transmit data and talk to each other. You would also gain exposure to exciting companies such as Uber, Microsoft, Google, or Tesla.

Invest well, sleep well

Of course, you may have sound reasons for retaining a larger allocation of your investment portfolio in smaller markets like New Zealand’s, such as to get higher returns. You may also want to support local companies, or want your returns from shares in New Zealand dollars. Or you might just want to invest in companies that you know well.

Ultimately there is no right or wrong answer as to how much money should go where. However, investing the entirety of your wealth in the New Zealand market is going to add a higher level of volatility to your investment performance, and give you more sleepless nights.

So look offshore as well as locally and help spread your risk and sleep better.

First published 16 November, 2016

By Jack Powell

The editorial below reflects the views of the editorial contributor only and content may be out of date. This article is sourced from a previous JUNO issue. JUNO’s content comes from sources that it considers accurate, but we do not guarantee that the content is accurate. Charts are visually indicative only. JUNO does not contain financial advice as defined by the Financial Advisers Act 2008. Consult a suitably qualified financial adviser before making investment decisions.

Informed Investor's content comes from sources that Informed Investor magazine considers accurate, but we do not guarantee its accuracy. Charts in Informed Investor are visually indicative, not exact. The content of Informed Investor is intended as general information only, and you use it at your own risk.